DEBT. SMARTER.

Practical insight for complex portfolios

How leading CRE teams manage risk, scale smarter, and stay compliant

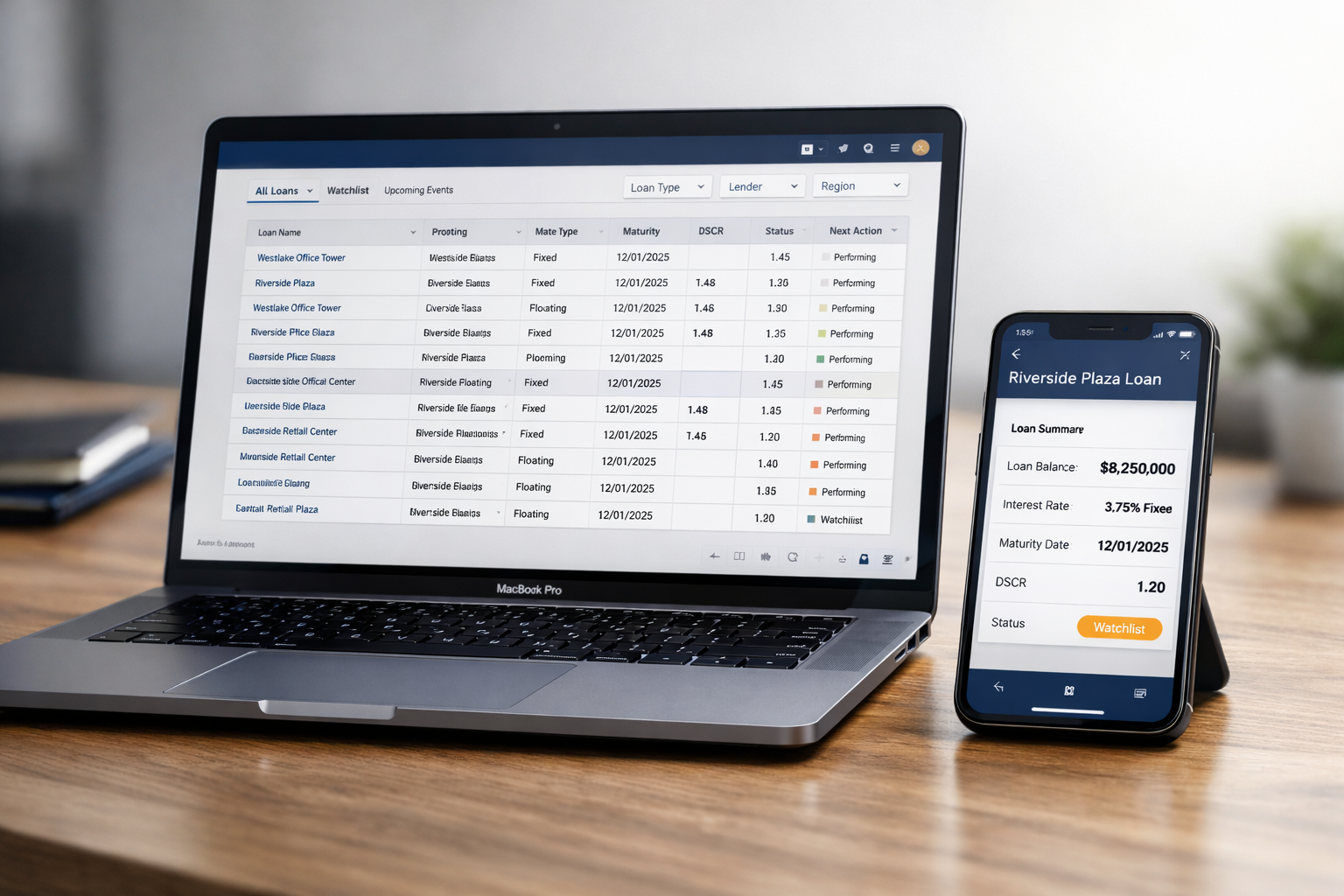

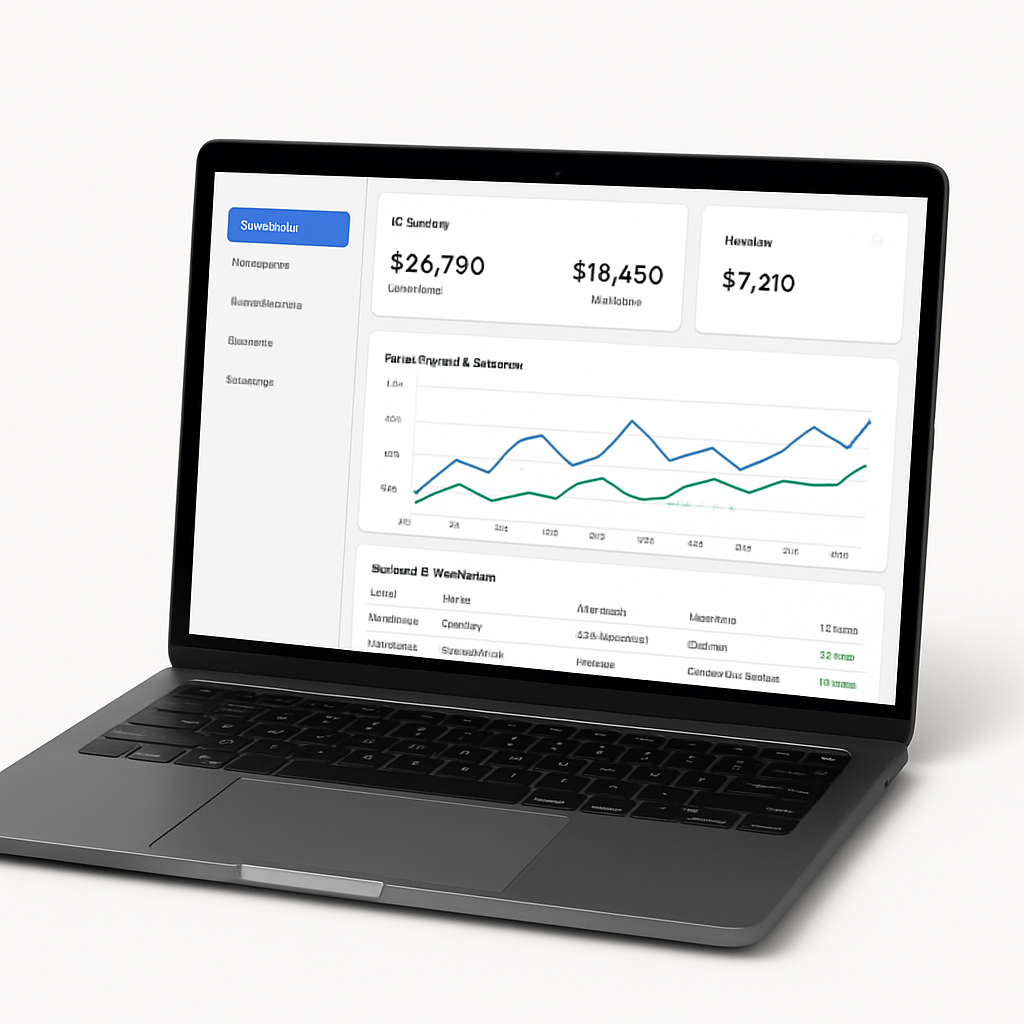

LoanBoss is an institutional grade platform for managing commercial real estate debt. By unifying loan docs, accounting, and live rates, it gives organizations a single, reliable foundation for managing portfolios with accuracy and control.

"It's really revolutionized our business. It's allowed us to grow and scale and it's a technology that I absolutely love. I think if you are a borrower, you need to have it."

Bryan Kallenberg | VP Capital Markets, Big V

COMPLIANCE

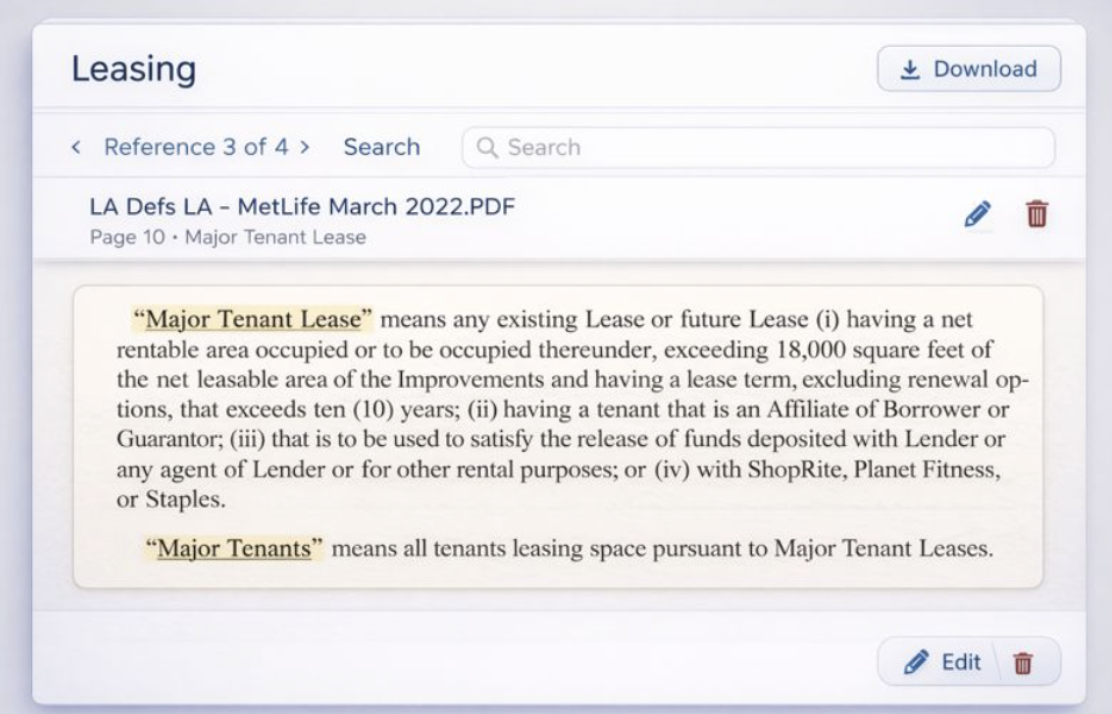

One click access to critical loan provisions

Lease approvals. Reserves. Post closing obligations. Conditions for draws. Insurance requirements. Recourse. Partial release. Hedge requirements. Lender adjustments to DSCR/DY. Material contracts.

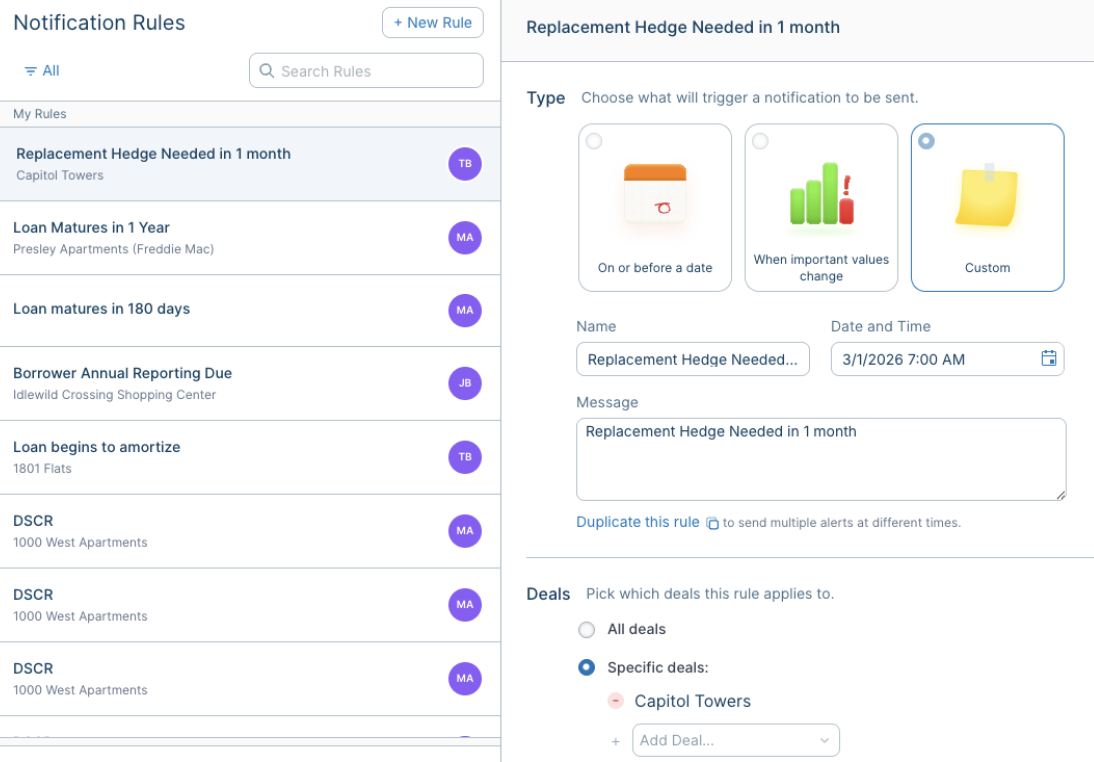

Track critical dates and metrics

- Lender compliance

- Extension notices

- Repair deadlines

- Forced funding dates

- Replacement caps

- Prepay changes

- IO ending

- Rate schedule changes

- Proceeds remaining

- Supplementals

I think we delete this

Compliance

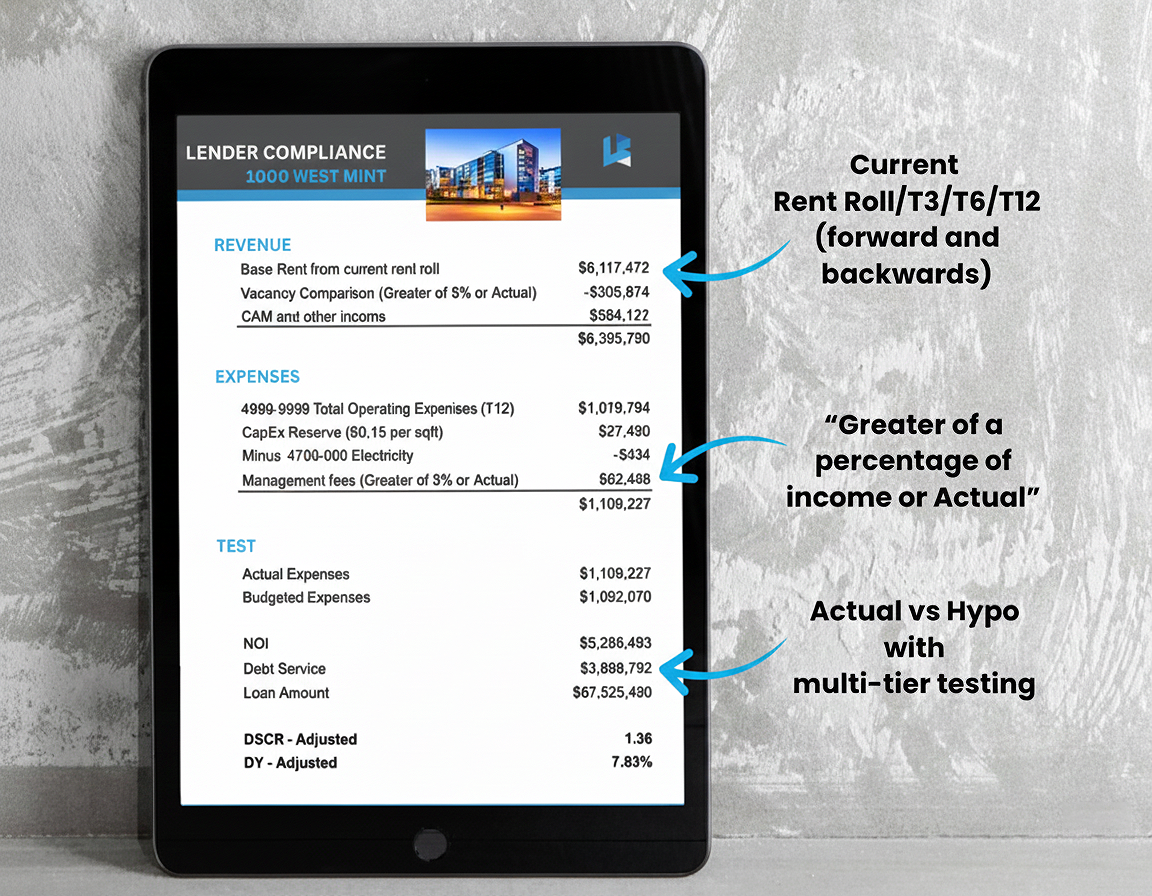

Automate Unique Lender Requirements

- Vacancy Comparison

- Rent roll adjustments for lease inception/termination

- Include increases to rent

- Exclude free rent

- Management Fee Comparison of the greater of 3% of Revenue or your actual management fees paid

- Reserve of $ per square foot of the property or $ per unit for multifamily properties

- Actual vs Hypothetical amortization

- Greater of fixed in place vs floating in place + spread vs treasury + spread

- Compare current/T3/T12

The LoanBoss lender compliance tool completely transformed how we handle covenant reporting. What used to take hours of manual spreadsheet work now runs automatically, with the flexibility to match every lender's unique DSCR or DY adjustment. It's fully integrated with our accounting data and delivers results we can trust instantly.

Mark Limpert, Co-Founder Orion Real Estate Partners

REPORTING

-2.png?width=2000&height=1120&name=Untitled%20design%20(2)-2.png)

-

"LoanBoss's reporting capabilities are incredibly robust. We sent them the internal reports our team was already using and they replicated them in the platform. They even worked with us to create customized reports. The best part is no more manual updates each month. Their tools have improved our reporting visibility and consistency across the organization."

Sean Grubbs SVP Capital Markets CapRock Partners

VALUATIONS

Every Valuation Your Stakeholders Need. Real-Time and on Demand.

Auditors want hedge calculations. Investors expect debt fair values. The board needs quarterly valuations.

These requests aren't surprises—but gathering the data shouldn't be a project.

DEBT VALUATION

Sophisticated owners and investors require debt to be marked to market (MtM).

Traditionally, this meant hiring an accounting firm to provide discounted cashflow modeling while also pulling together market comps for credit value adjustments.

But what does a CMBS loan on a Class A Office in New York have to do with Industrial in Dallas?

Why are firms that don't specialize in real estate providing marks on Retail in LA?

LoanBoss handles the complex math—discounting cashflows, calculating duration, running sensitivities. But your trusted advisors input the credit spreads and market assumptions.

Stop outsourcing debt valuation to people you don't trust.

We run the models. You provide the expertise. Together, it's more accurate and less volatile.

Download Debt Valuation

HEDGE MARK-TO-MARKETS

Hedge cashflows and live interest rates. That's all you need to value a hedge. It shouldn't be hard to calculate MtMs each month.

Now it isn't.

Built by the hedging experts at Pensford, your swap valuations update continuously with live rates.

Every curve shift, every basis movement—instantly reflected in your marks.

No spreadsheet builds. No emails to third parties asking for updates. No month-end scramble.

The math was always simple. Now the process is, too.

Download Sample Hedge MtM ReportAsset Values: BOV & Third-Party Tracking

Your brokers provide annual valuations. You have historical appraisals. You run your own numbers. All critical data points—all trapped in PDFs in someone's inbox.

Upload them directly to each asset in LoanBoss. Track valuation trends over time. Compare BOVs across properties.

When the board asks how values have moved, you're not searching emails from two years ago. You're pulling charts. When investors question marks, you're showing trends, not defending snapshots.

“You should choose LoanBoss because of the transparency.

Transparency in calculations.

Transparency in abstracts.

Transparency with the team."

Arun Singh,

CEO and Founder Radial Capital

.png?width=317&height=332&name=image%20(84).png)

%20(1).png)